As online platforms continue to expand, security and user verification have become central concerns for both operators and users.

Digital services increasingly balance accessibility with compliance, shaping how people register, interact, and protect their personal data across entertainment environments.

Within online gaming ecosystems, different verification models now coexist. Some platforms prioritize full identity checks at registration, while others streamline onboarding and apply risk-based controls later in the user journey.

This has led to the growing visibility of casinos with no verification, which operate under alternative compliance structures while still applying internal monitoring, transaction controls, and responsible use safeguards.

The Foundations of Online Security

At the core of any digital platform’s security strategy lies data protection. Platforms collect a wide range of information, from email addresses and passwords to payment details and behavioral data. Securing this information typically begins with encryption protocols, such as SSL (Secure Socket Layer) or TLS (Transport Layer Security), which protect data as it moves between the user and the platform.

Beyond encryption, platforms rely on firewalls, intrusion detection systems, and regular vulnerability testing to prevent unauthorized access. These measures are largely invisible to users, yet they play a critical role in ensuring trust. A single breach can damage not only finances but also long-term credibility.

Regular software updates and patch management are another essential layer. As cyber threats evolve, platforms must continuously adapt, closing newly discovered loopholes before they can be exploited.

Why User Verification Exists

User verification is often misunderstood as a barrier rather than a safeguard. In practice, verification systems are designed to confirm that users are who they claim to be and that they meet the platform’s legal and operational requirements.

In sectors involving financial transactions, verification helps prevent fraud, money laundering, and identity theft. It also supports responsible usage by enforcing age restrictions and regional regulations. These checks protect both the platform and its users, even if they introduce additional steps during onboarding.

However, not all verification processes are the same. Platforms choose different approaches depending on their risk profile, audience, and regulatory environment.

Traditional Verification Models

Conventional verification methods usually involve submitting personal documents, such as government-issued IDs, proof of address, or bank statements. These processes are often referred to as Know Your Customer (KYC) checks and are widely used in banking and regulated financial services.

While thorough, traditional verification can feel time-consuming. Uploading documents, waiting for approval, and navigating manual reviews may interrupt the user experience. For some users, particularly those accustomed to instant digital services, this friction can be a deciding factor.

As a result, many platforms have explored alternative verification models that still maintain security standards without excessive complexity.

Technology-Driven Verification Solutions

Advancements in technology have enabled faster and more flexible verification methods. Automated identity checks using AI can compare uploaded documents with selfies or video confirmations in seconds rather than hours. Biometric verification, such as fingerprint or facial recognition, adds another layer of security while reducing reliance on paperwork.

Device fingerprinting and behavioral analysis also help platforms identify suspicious activity. By analyzing login patterns, device types, and usage behavior, systems can flag anomalies without requiring constant user input.

These tools allow platforms to focus verification efforts where they are most needed, rather than applying the same level of scrutiny to every interaction.

The Role of Minimal Verification Models

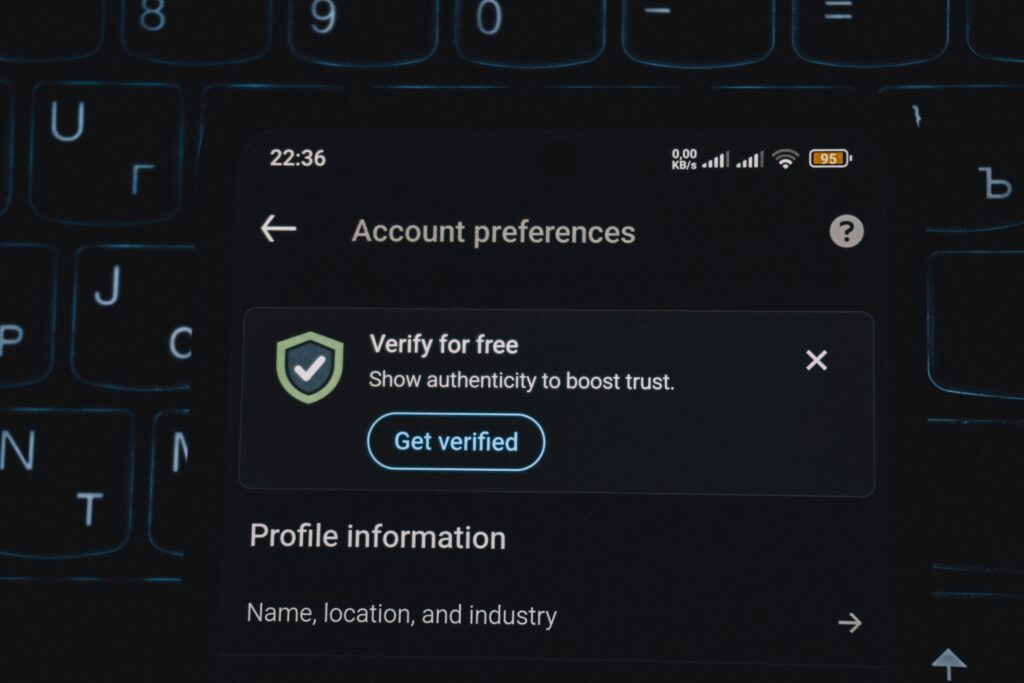

In recent years, there has been growing interest in platforms that operate with streamlined onboarding processes. Some online services emphasize reduced data collection, asking only for essential information to get users started.

Within iGaming and digital entertainment, this approach has led to the emergence of environments commonly referred to as casinos with no verification. Rather than eliminating security altogether, these platforms rely on alternative safeguards such as transaction monitoring, payment-level checks, and withdrawal thresholds to manage risk.

For users, the appeal lies in faster access and increased privacy. For platforms, the challenge is maintaining compliance and security without traditional document-heavy procedures.

Payment Methods as a Security Layer

Payment systems themselves play a significant role in verification. Many platforms leverage trusted payment providers that already perform identity checks at the financial level. When users transact through regulated banks, e-wallets, or blockchain-based systems, part of the verification responsibility shifts to those providers.

Cryptocurrency payments, for example, reduce the need to share sensitive banking details while still offering transparent transaction records. However, they also require platforms to implement strong monitoring tools to prevent misuse.

By integrating secure payment infrastructures, platforms can reduce onboarding friction while maintaining a controlled environment.

Regulatory Influence on Security Practices

Security and verification requirements are heavily influenced by regulation. Different jurisdictions impose varying standards on how platforms must identify users, store data, and report activity. This is why global platforms often apply region-specific rules, adapting their systems depending on where users are located.

Compliance teams work alongside technical departments to ensure that security measures meet both legal obligations and user expectations. Failure to comply can result in fines, service restrictions, or loss of operating licenses.

At the same time, regulators are increasingly recognizing the need for proportionate approaches, allowing innovation in how verification is handled without compromising safety.

User Trust and Transparency

Security systems are most effective when users understand them. Clear communication about why certain data is collected and how it is protected helps build confidence. Platforms that explain their verification processes transparently tend to experience higher retention and lower abandonment rates.

Trust also grows when users are given control, such as the ability to manage privacy settings, review login activity, or enable additional security features like two-factor authentication.

In this sense, security is not just a technical requirement but a relationship between platform and user.

The Future of Online Security and Verification

Looking ahead, online platforms are likely to continue refining their security models. Expect greater use of AI-driven risk assessment, decentralized identity solutions, and real-time monitoring tools that adapt dynamically to user behavior.

The goal is not to remove verification entirely, but to make it smarter, faster, and more context-aware. Platforms that succeed will be those that protect users without making security feel like an obstacle.

As digital ecosystems expand, security and verification will remain foundational elements — quietly working in the background to ensure that online experiences are not only convenient, but also safe and trustworthy.