Are you unsure about how to calculate and pay your SSS contributions correctly?

Do you wonder why, in today’s digital world, the process of paying contributions isn’t entirely online? Are you upset about the delay in seeing your payments reflected, even though it should be instant?

These are the initial challenges of implementing the new Social Security Law and an SSS program for real-time posting of contributions.

Adapting to significant changes can be tough, but equipping yourself with knowledge will save you time and effort when managing your SSS contributions.

Here’s everything you need to understand about calculating your SSS contribution with the latest SSS contribution tables.

Who is Allowed to Make SSS Contributions?

All employees, self-employed individuals, non-working spouses, and OFWs under 60 who have an SSS number are eligible to make their SSS contributions to begin or continue their coverage.

Members eligible for coverage can receive social security benefits for sickness, unemployment, childbirth/miscarriage, disability, retirement, or death.

Unemployed Filipinos can contribute as voluntary members only if they were previously registered as employed, self-employed, or OFW members and have at least one month of contributions recorded.

The SSS does not permit initial contributions as a voluntary member unless the individual was previously registered as employed, self-employed, or an OFW. Voluntary members can continue making contributions to maintain their SSS coverage after their employment ends.

Self-employed individuals in the informal sector, like farmers and fishermen, can choose to pay their SSS contributions voluntarily.

As they are the most vulnerable group, SSS provides them a flexible payment plan. This plan lets them pay their monthly dues anytime within the twelve months prior to their payment deadline.

For example, if they need to pay by October 2022, they can make payments from October 2021 to September 2022. This extends their payment window, offering a longer period to pay compared to the previous three-month allowance before their due date.

Why Should You Make Regular Contributions?

If you have a tight budget, your monthly SSS contribution might feel like an extra cost. But, you will see its worth when you are sick, hurt, unemployed, low on money, or retiring.

Making SSS contributions helps you save for the future. It’s wise to keep building your financial safety net for retirement by making these payments while you still have an income.

Also, the SSS calculates a member’s benefits based on the total number and amount of contributions paid.

To qualify for an SSS benefit or loan, members must meet these requirements:

- Salary loan: Minimum of six monthly contributions posted in the last 12 months and a total of at least 36 monthly contributions.

- Sickness/Maternity benefit: Minimum of three monthly contributions posted within the 12 months prior to the semester of sickness, injury, childbirth, or miscarriage.

- Disability benefit: At least one monthly contribution posted before the semester of disability.

- Retirement benefit: A minimum of 120 monthly contributions posted before the semester of retirement to qualify for a monthly pension.

- Death benefit: At least 36 monthly contributions posted before the semester of the member’s death for beneficiaries to receive a monthly pension.

- Funeral Benefit: at least one payment made before the member’s death.

Unemployment/Involuntary Separation Benefit – At least 36 monthly payments are required, with 12 of these payments made in the 18 months leading up to the month the member becomes unemployed.

How to Determine Your Monthly SSS Contribution: Essential Steps?

The amount that members pay to the SSS varies based on two things:

- Type of membership: The contributions for employees, kasambahays, and some OFWs are taken out of their monthly salary and paid to the SSS (together with the part paid by the employer) by their employers. Others must pay their full contribution themselves.

- Monthly salary credit (MSC): The Social Security Law describes MSC as “the basis for calculating contributions and benefits.” The SSS uses the MSC to determine the contribution amount for members based on their monthly earnings.

The more you earn each month, the higher your MSC will be. A higher MSC means a higher contribution. On the SSS contribution table, you can see the MSC that matches your income level.

New Schedule for SSS Contributions

Before you start calculating your contribution, be aware of the important updates to the SSS Contribution Schedule due to the Social Security Act of 2018.

Starting in January 2023, the contribution rate rose to 14% of the MSC and will increase by 1% every two years until it reaches 15% by 2026.

The legislation also raised the minimum MSC from ₱3,000 in 2021 to ₱4,000 in 2023. This adjustment will impact all SSS members except for Kasambahay and Overseas Filipino Workers, who will maintain a minimum MSC of ₱1,000 and ₱8,000, respectively.

Similarly, the highest MSC will go up from ₱25,000 in 2021 to ₱30,000 in 2023.

What does this mean? You will pay more each month. However, your SSS benefits will also go up because they are based on a higher MSC.

In the end, the rise in SSS contributions will prolong the life of the SSS fund, improving your chances of getting retirement benefits later on.

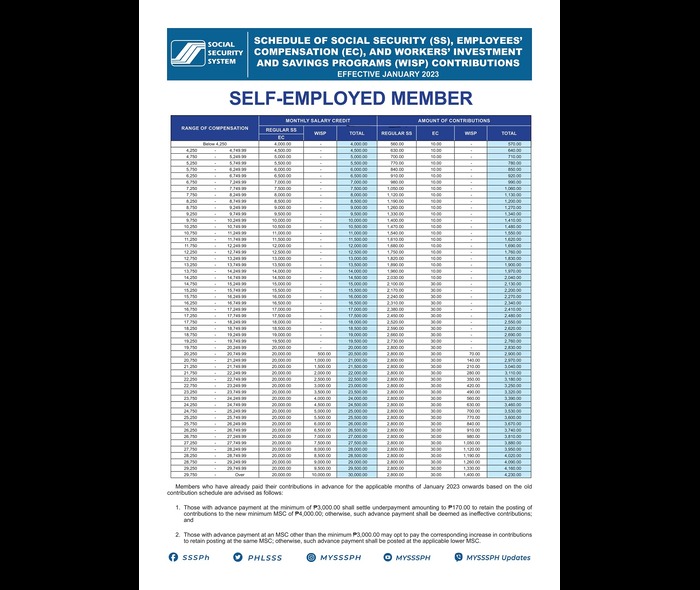

The 2023 Social Security System Contribution Chart

1. Active Workforce Members

Out of the 14% total contribution rate, employees pay 4.5% from their monthly wages, while employers cover the remaining 9.5%.

Furthermore, employers must also pay a monthly contribution for the Employees’ Compensation (EC) Program. This is ₱10 for each employee who earns less than ₱15,000, and ₱30 for those earning ₱15,000 or more.

Employers must ensure they submit all these contributions to the SSS promptly.

Here’s a guide for both employers and employees on calculating the monthly contribution using the updated SSS contribution table:

- In the first column labeled “Range of Compensation,” locate the salary range that matches your current monthly income and note down the Monthly Salary Credit (MSC) shown in the “Total” column.

For now, let’s concentrate only on the MSC. We’ll cover terms like Mandatory Provident Fund and WISP later.

For instance, the updated table indicates that employees earning between ₱19,750 and ₱20,249.99 have an MSC of ₱20,000.

- If you are an employer: Look up the contribution amount for an individual employee in the ER column that matches the employee’s MSC. For an employee with an MSC of ₱20,000, you need to contribute ₱1,900 for the SSS and ₱30 for the EC, making a total of ₱1,930 out of your pocket.

- If you are an employee, Find your monthly SSS contribution deduction in the EE column that corresponds to your MSC. Based on the example, if your MSC (Monthly Salary Credit) is ₱20,000, your employer must take ₱900 out of your monthly salary.

- To find out the total monthly contribution, check the far-right column. For an employee with an MSC of ₱20,000, the total monthly contribution amounts to ₱2,830 (₱900 from the employee and ₱1,900 from the employer, including a ₱30 EC contribution). This total must be paid by the employer to the SSS and will be recorded on the employee’s SSS account after payment.

You can also calculate the monthly contribution using the MSC x Contribution Rate method.

Taking the same MSC of ₱20,000 as an example:

Employee’s contribution: ₱20,000 x 0.045 (4.5% contribution rate) = ₱900

Employer’s contribution: ₱20,000 x 0.095 (9.5% contribution rate) = ₱1,900 (plus ₱30 for EC)

Total contribution: ₱900 + ₱1,930 = ₱2,830

- In addition to their usual payments, certain SSS members with an MSC of more than ₱20,000 must now contribute to a new provident fund known as the Workers’ Investment & Savings Program, or WISP.

The WISP is a tax-free retirement saving plan that will serve as a supplement to your SSS pension benefits. Thus, government workers are not included and will not have pay cuts for WISP.